VA 201-R 2013-2024 free printable template

Show details

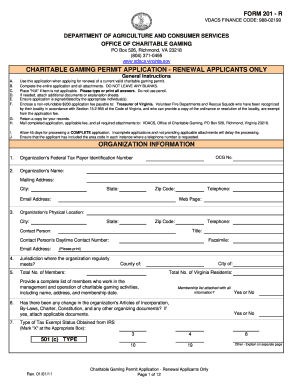

FORM 201 - R VDACS FINANCE CODE 988-02199 VIRGINIA DEPARTMENT OF AGRICULTURE AND CONSUMER SERVICES OFFICE OF CHARITABLE AND REGULATORY PROGRAMS PO Box 526 Richmond VA 23218 804 371-0495 www. vdacs. virginia.gov CHARITABLE GAMING PERMIT APPLICATION - RENEWAL APPLICANTS ONLY A. B. C. D. E. F. G. H. FORM 201 - R VDACS FINANCE CODE 988-02199 VIRGINIA DEPARTMENT OF AGRICULTURE AND CONSUMER SERVICES OFFICE OF CHARITABLE AND REGULATORY PROGRAMS PO Box 526 Richmond VA 23218 804 371-0495 www. vdacs....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 201r charitable gaming form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 201r charitable gaming form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 201r charitable gaming form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 201r charitable gaming form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

VA 201-R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 201r charitable gaming form

How to fill out 201r charitable gaming form:

01

Gather all necessary information and documents such as the organization's name, address, and tax identification number.

02

Identify the type of gaming activity being conducted and provide specific details including the date, time, and location.

03

Provide a description of the purpose and beneficiaries of the charitable gaming event.

04

Determine the gross receipts and expenses associated with the gaming activity and report them accurately on the form.

05

Calculate the net proceeds from the gaming event by subtracting the expenses from the gross receipts.

06

Fill out the required sections for the distribution of net proceeds, including how the funds will be used for charitable purposes.

07

Sign and date the form, ensuring that all information provided is accurate and complete.

08

Submit the completed form to the appropriate regulatory agency along with any required fees or additional documentation.

Who needs 201r charitable gaming form:

01

Nonprofit organizations or charitable institutions that conduct gaming activities for fundraising purposes.

02

Organizations or individuals involved in organizing or managing charitable gaming events.

03

Regulatory agencies or government entities responsible for overseeing and monitoring charitable gaming activities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file 201r charitable gaming form?

It seems there might be a typographical error in your query as "201r charitable gaming form" does not appear to be a specific form. However, if you are referring to the IRS Form 990, that is required to be filed by tax-exempt organizations that meet certain criteria. These organizations include most charitable organizations, religious organizations, educational institutions, and other tax-exempt organizations under section 501(c) of the Internal Revenue Code. To determine whether an organization needs to file Form 990 or any specific form, it is recommended to consult with a tax professional or refer to the IRS guidelines.

What is the purpose of 201r charitable gaming form?

The purpose of the 201R charitable gaming form is to report and track the revenues, expenses, and activities related to charitable gaming events. This form is typically used by nonprofit organizations and charities that conduct various types of gambling activities, such as bingo games or raffles, in order to raise funds for their charitable purposes. By completing this form, these organizations can provide the necessary information to the relevant tax authorities and comply with the reporting requirements for their gaming activities.

What information must be reported on 201r charitable gaming form?

The specific information required to be reported on the 201R Charitable Gaming Form may vary depending on the jurisdiction and its corresponding regulations. However, common information typically included on this form may include:

1. Organization details: The name, address, and contact information of the charitable organization.

2. Gaming activities: Description of the gaming activities conducted by the organization, such as bingo, raffles, lotteries, pull-tabs, etc.

3. Dates and locations: The dates and specific locations at which the gaming activities were held.

4. Gross gaming receipts: The total amount of money collected from gaming activities, including ticket sales, entry fees, and any other form of payment.

5. Prize expense: The total amount paid out in prizes or winnings to the participants.

6. Charitable purpose: The specific charitable purpose or organization benefitting from the proceeds of the gaming activities.

7. Expenses: Detailed breakdown of all expenses related to the gaming activities, including expenses for equipment, supplies, staff, marketing, and any other costs incurred.

8. Net proceeds: The net proceeds from the gaming activities, calculated by subtracting the expenses from the gross gaming receipts.

9. Signatures: Signature of an authorized representative of the organization, acknowledging the accuracy and completeness of the information provided.

It is important to consult the specific regulations and guidelines of the jurisdiction where the gaming activities are being conducted to ensure compliance.

How do I edit 201r charitable gaming form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 201r charitable gaming form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit 201r charitable gaming form in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your va dept of agriculture consumer servies form 201 r, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit gaming commission form 201 r on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing virginia charitable gaming forms.

Fill out your 201r charitable gaming form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

201r Charitable Gaming Form is not the form you're looking for?Search for another form here.

Keywords relevant to 201r charitable gaming form

Related to 201r charitable gaming form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.